|

| Nike's revenue break-down - marketrealist.com |

There we've seen to come out the first few company reports. The earliest company in the row - as usually - was the DOW30 component Nike (NKE).

Nike's Q3 EPS is $1,34, up 23% Y/Y. Expected EPS was $1,19.

Its revenues up 5% to $8.4 billion, up 14% on a currency-neutral basis.

Nike shares surged 9% to a record high on 24th of Sept.

Costco (COST) also came out with its numbers on 28th of Sept.

EPS $1,72, while analysts awaited only $1,66.

Net sales $34,99B which missed previously thought $36,26B.

Micron Technology Inc (MU) - which is one of Blogger's favorite chip maker - jumped 12% on earnings beat. The company reported non-GAAP EPS of $0.37 for the quarter, down from $0.82 during the fourth quarter of 2014. Analysts were expecting of

$0.33. Profitability collapsed in the Compute Networking Business Unit,

which includes PCs, with the segment operating margin declining by 10

percentage points from the third quarter to 7.6%. The mobile business

remained quite profitable, with an operating margin of 27.3%.

On 6th of October Pepsi (PEP) released its latest earnings report before opening bell on Tuesday morning, posting adjusted earnings of $1.35 per share and sales of $16.3

billion, a 5% year over year decline. Analysts had been expecting

earnings of $1.26 per share and revenue of $16.22 billion. Shares popped.

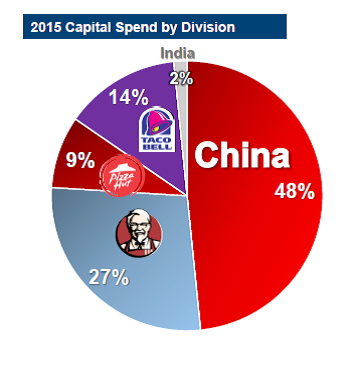

Tuesday was black for Yum! Brands (YUM). It's share downed 17% after poor numbers. Yum's adjusted earnings came in at $1.07/share on $3.42B of

revenue. This badly missed forecasts. Analysts expected $3.68 billion of

revenue.

Yum's same-restaurant sales, grew just 2% last quarter in China. Analysts had

expected 9%. (China itself makes up more than half of Yum's operating profit.)

|

| Capital spends (YUM) - financialorbit.tumblr.com |

Nincsenek megjegyzések:

Megjegyzés küldése

Megjegyzés: Megjegyzéseket csak a blog tagjai írhatnak a blogba.